We are thankful for those who have made an estate gift to The Huntington. Here are their stories.

Free Estate Planning Tool

Join fellow The Huntington supporters on Giving Docs, a safe, secure, and free-for-life suite of estate plan essentials.

Get Started

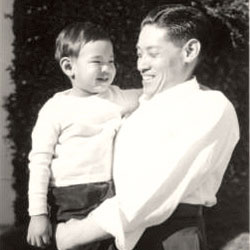

Our Enduring Connection with The Huntington

Our connection to The Huntington goes back a long way, even beyond our almost 40-year membership. Before Brenda was born, there was a family connection to The Huntington—a small black and white photo from 1939 shows Brenda's older sisters and her mother sitting on the edge of the fountain in front of The Huntington Library.

Read More

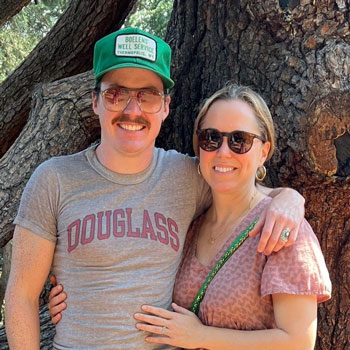

Giving Back to Our Community

By joining the Heritage Society and the Society of Fellows, our hope is that the gifts we make will continue to allow people of all ages and backgrounds to experience this wonderful place.

Read More

Building on a Legacy of Giving

M.E. Purnell began her journey with The Huntington thanks to her grandparents. Today, she is building on their legacy by sharing The Huntington with others in more ways than one.

Read More